The Property Price must be less than RM500000. Home Stamp Duty Legal Fees Calculator.

Best Calculator For Property Stamp Duty Legal Fees In Malaysia Free

Stamp Duty - Sale Purchase Transfer.

. For the first RM500000. Visualize the monthly instalment legal fees and stamp duties for buying a house in Malaysia. Legal Fees and Stamp Duty Calculator.

This calculator calculates the estimated or approximate fees needed for Stamp duty on Memorandum of Transfer MOT. SPA Loan Agreement quotation includes Legal fees amount Disbursement Fees 6 SST and stamp duty. The calculations done by this calculator is an estimation of Stamp Duty on MOT of house purchase in Malaysia it gives you an idea how much money you.

Please contact us for a quotation for services required. The stamp duty for a Sale and Purchase Agreement is often mistaken for the stamp duty for Instrument of Transfer. This could be at least a few hundreds tobe add on.

Legal fees calculator to calculate legal fees and stamp duty for a Tenancy Agreement. Loan Documentation Stamp Duty. Stamp duty exemption is capped at RM300000 on the property market value and loan amount.

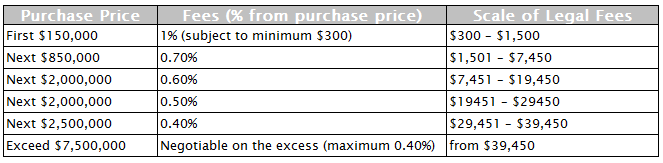

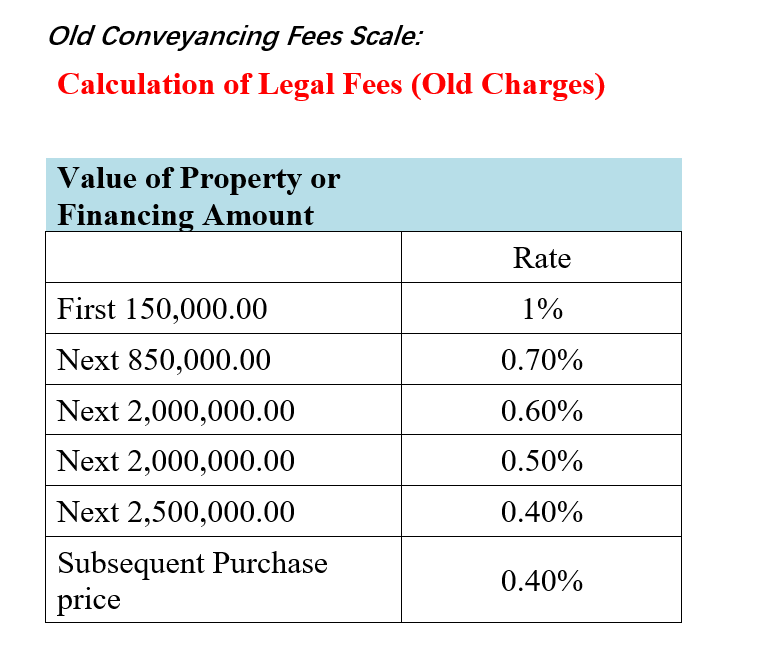

Legal fees for sale and purchase agreements and loan agreements are regulated by the Solicitors Remuneration Amendment Order 2017. Loan Sum 300000 X 05. Artikel Undang-Undang di.

For property price exceeding RM75 million legal fees of the excess RM75 million is negotiable but subjected to maximum of 05. Stamp Duty Calculator. The calculation formula for Legal Fee Stamp Duty is fixed as they are governed by law.

However the below home loan calculator provides an estimation of the repayment amount. We have made. 1 Legal Calculator App in Malaysia.

Stamp duty for Memorandum of transfer in Malaysia MOT Malaysia can be extremely pricey and do check out the chart below for the tier rate. Calculate now and get free quotation. The calculation formula for Legal Fee Stamp Duty is fixed as they are governed by law.

Legal Fees Stamp Duty Calculator For Sale PurchaseSP And Loan Agreement calculation and quotation for purchasing property in Malaysia Petaling Jaya KL Johor Bahru. The calculation formula for Legal Fee Stamp Duty is fixed as they are governed by Sarawaks law. The calculation formula for Legal Fees Stamp Duty is fixed as they are governed by law.

The practice in Malaysia is that the legal fees for the tenancy agreement are borne by the tenant. The amount may be different from individual banks or financial institutions. Lokasi Mahkamah Syariah Malaysia.

Legal advice for divorce family Law dispute debt recovery litigation probate estate SP corporate agreement mergers defamation due diligence employment. Legal Fees Calculator. The calculation formula for Legal Fee Stamp Duty is fixed as they are governed by law.

Calculate Stamp Duty Legal Fees for property sales. SPA Stamp Duty. Luckily Low Partners created a handy Legal Fee and Stamp Duty calculator which you can easily use to calculate the exact amount you need to pay when buying and selling a property.

This website belongs to GTRZ. From 1st April 2015 there will additional 6 government tax on total lawyer fee for Sales and Purchase Agreement. The standard legal fees chargeable for tenancy agreement are as follows-First RM 10000 rental 25 of the monthly rent.

And intended for educational or reference purposes only as such it should. The following powerful calculator is designed for public to estimate the legal fees and stamp duty incurred when they are buying any property in the state of Sarawak. REQUEST A FREE CONSULTATION.

The calculation formula for Legal Fee Stamp Duty is fixed as they are governed by Sabahs law. Total Legal Fees Payable. Stamp duty calculation will be based on every RM250 of annual rental in excess of RM2400.

Get quotation for free from law firm. Purchased Price 350000. Stamp Duty Calculator.

Stamp Duty 100000 x 1 40000 x 2 6000. Legal fees calculator to calculate legal fees and stamp duty for a Tenancy Agreement. This calculator calculates the estimated or approximate legal fees on SPA needed to be paid by buyers when purchasing a house in Malaysia.

The copyright to the. Legal Fees Stamp Duty Calculator For Sale PurchaseSP And Loan Agreement. The calculation formula for Legal Fee Stamp Duty is fixed as they are governed by law.

Stamp Duty Legal Fees Online Calculator. The calculation formula for Legal Fee Stamp Duty is fixed as they are governed by law. 5A Jalan SS 2123 Damansara Utama Petaling Jaya 47400 Selangor Malaysia.

Kelana Square 17 Jalan SS726 47301 Petaling Jaya Selangor Darul Ehsan Malaysia. You will get a full summary after clicking Calculate button. 21 1st Floor Block A2 Saradise Off Jalan Stutong Kuching 93350 Sarawak Malaysia.

Loan Sum x 05. Fill in the house price. Property Purchase Price.

Legal Fee - Sale Purchase Agreement Loan Agreement. Please contact us for a quotation for services required. For the next RM500000.

The calculations done by this calculator is an estimation of the Legal Fees on SPA for house purchase. Calculate Stamp Duty Legal Fees for property sales purchase mortgage loan refinance in Malaysia. Check out our up-to-date Home Loan and Home Refinance comparison tools.

Please contact us for a quotation for services required. The stamp duty for the SPA is only RM10 per copy while the stamp duty for MOT and DOA is calculated according to a fee structure of 1 to 4. Stamp Duty Loan Calculation Formula.

With above calculations there is miscellaneous fee for preparation of Sales and Purchase Agreement. A simple stamp duty calculator legal fees calculator for property sales purchase mortgage loan refinancing in malaysia. And intended for educational or reference purposes only as such it should.

The calculator will automatically calculate total legal or lawyer fees and stamp duty or Memorandum of Transfer MOT. Calculator - For Malaysia Sale and Purchase Agreement legal fee loan fee and stamp duty of property. Please note that the above formula merely.

The Property Price greater than RM500000. The following powerful calculator is designed for public to estimate the legal fees and stamp duty incurred when they are buying any property in the state of Sabah. You will get a full summary after clicking Calculate button.

Both quotations will have slightly different in terms of calculation. Key in your purchase price and our stamp duty calculator would let you know how much is the. Loan Documentation Legal Fees.

Selangor Malaysia Mon-Fri 9am-6pm T 6 03 7887 2702 F 6 03 7887 2703 M 6 017 887 2702. Legal Fees Stamp Duty Calculator For Sale PurchaseSP And Loan Agreement. Calculator - For Malaysia Sale and Purchase Agreement legal fee loan fee and stamp duty of property.

الحوار مذكرات خزانة House Stamp Duty Calculator Paperlightstudio Com

Best Calculator For Property Stamp Duty Legal Fees In Malaysia Free

Stamp Duty Legal Fees Malaysia 2022 For Purchasing A House

الحوار مذكرات خزانة House Stamp Duty Calculator Paperlightstudio Com

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia

الحوار مذكرات خزانة House Stamp Duty Calculator Paperlightstudio Com

Malaysia Legal Fees Cal Apps On Google Play

Stamp Duty Legal Fees New Property Board

How Legal Fees Increased Affects Homeowners Malaysia Housing Loan

Buying A House Here S 2022 Stamp Duty Charges Other Costs Involved

Calculators Legal Fee Sale Purchase Agreement Loan Agreement

How Legal Fees Increased Affects Homeowners Malaysia Housing Loan

How Much Does It Cost For Stamp Duty For Tenancy Agreement In Malaysia Property Malaysia

Cost Of Buying House In Malaysia

What Is A Trust Deed And Why Is It Important

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia

Malaysia Real Estate Kuala Lumpur Property Legal Fees Stamp Duty Calculation When Buying A House In Malaysia

Malaysia Real Estate Kuala Lumpur Property Legal Fees Stamp Duty Calculation When Buying A House In Malaysia